While many homeowners trying to get the best home guarantee financing have a tendency to simply be capable availability preparations for fifteen- otherwise 31-seasons symptoms, Countries also provides a variety of installment lengths undertaking at eight many years.

The fixed-speed home equity loans initiate in the $10,000 and certainly will increase so you’re able to $250,100

Fixed rates getting domestic guarantee money as a result of Regions Bank start from the 3.25% and you may rise so you’re able to %. Reduced prices for vehicle-shell out enrollment is straight down one to speed to three.0%.

On first half a year, homeowners who use Nations Bank having a beneficial HELOC will take pleasure in an excellent fixed basic speed from 0.99%. It then expands in order to a variable rate dropping anywhere between 3.75% and you can %.

Countries Bank supplies the better home equity finance and HELOCs. Fees terms can be seven, ten, fifteen or twenty years.

The newest HELOCs begin within $10,000 but i have all in all, double their home security loans, having $500,one hundred thousand readily available for accredited people. HELOCs really works in different ways than household equity financing in some ways; a person is one to repayment doesn’t start up until shortly after what is actually called an effective draw period, where people is also acquire using their HELOC. Nations Bank also offers HELOCs that have 10-year mark symptoms with 20-seasons installment attacks.

To possess HELOCs away from $250,100 or less than, Places Financial protects all the settlement costs. To possess lines of credit a lot more than $250,100000, Countries Financial tend to lead as much as $500 to closing costs.

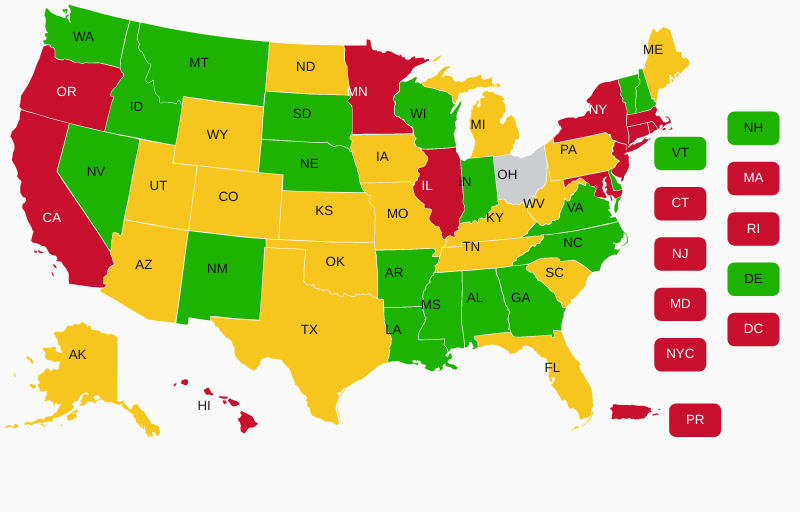

Minimal credit history you’ll need for a regions Bank house collateral loan is not unveiled. In case the home is perhaps not based in one of several sixteen claims in which Countries Bank enjoys a department, you will not be able to get property collateral financing or HELOC using him or her. Already, Regions Bank only has twigs inside the Alabama, Arkansas, Fl, Georgie, Iowa, Indiana, Illinois, Kentucky, Louisiana, Mississippi, Missouri, New york, South carolina, Tennessee and you can Texas.

A knowledgeable house equity fund and HELOCs enforce for on the web, really during the an areas Bank branch or because of the cellular telephone within 1-888-462-7627 away from 6 a beneficial.m. to help you 7 p.meters. Monday because of Saturday and you may 8 a great.yards. to dos p.m. for the Saturdays. You are able to Area Bank’s calculator to find out if a property equity financing is a practicable option for that combine their loans. You may also assess your prospective HELOC costs playing with Region Bank’s commission calculator .

- Truist will pay for your own appraisal

- Fees options are versatile

- Fixed-rate fees options are readily available

- https://paydayloansconnecticut.com/derby/

- For residents regarding Alabama, Fl, Georgia, Indiana, Kentucky, Nj-new jersey and you will Kansas, an annual percentage enforce

- Punishment to own closing personal line of credit in this 3 years

Needed suggestions has yours advice and that of your co-applicant if you find yourself using jointly, employer guidance, financial possessions and expense and you will a reason of equity, including your bank identity and you will balance to help you well worth

Of these finding property collateral personal line of credit, Truist is a solid choice that have a reduced minimal borrowing amount and you may a relatively brief techniques go out.

Truist’s interest levels are on new large top, performing during the cuatro.5% and you will going the whole way to sixteen% or even the nation’s restrict.

Truist’s HELOCs keeps a minimum of $5,000, nevertheless limitation relies on new applicant’s creditworthiness and the matter from equity obtainable in our home. Cost can be made more 5, ten, fifteen and you can 20-year terms and conditions having repaired-price HELOCs. Of these which have varying costs, although, the fresh new draw months try 10 years additionally the installment period was 20 years.

Truist’s ideal house equity finance come in the says, however the company cannot identify the very least credit score needed to own people. So you’re able to meet the requirements, homeowners need sufficient security in their house and you may show its creditworthiness using important mortgage files particularly a position verification, credit score, W-2s and a lot more.

For these looking a simple return, Truist is a quality option with a single-time recognition time for accredited applicants.