Building security of your house was a captivating section of homeownership. Strengthening guarantee mode increasing the part of a secured item you possess – in cases like this, the brand new portion of your home than the exactly how much you will still are obligated to pay on your home loan. Settling your own home loan was an organic technique for building equity, however you could be wanting to know in the event the there are ways to expedite this process. Let us hunt.

What exactly is household equity?

House guarantee is the level of house you possess compared to the how much you owe. Their advance payment ‘s the first biggest share you create to the your residence security. The bigger brand new deposit you make, more house collateral you start out-of which have. Since you pay their home loan, you begin in order to more and more are obligated to pay less cash and you can very own way more household equity.

How can i learn my personal household security?

It is possible to calculate family security because of the subtracting the new a fantastic harmony out-of the home loan in the appraised worth of your property. Including, in the event the residence’s appraised well worth is $eight hundred,000 and your the home loan balance is $100,000, then your domestic guarantee would-be $three hundred,000.

What makes building home guarantee very important?

Building domestic security represents essential several causes. Brand new overarching motif is that so much more collateral provides you with more control more than their house. Generally, after you purchase a house, the aim is to own the brand new advantage and you can give it time to appreciate throughout the years just before at some point attempting to sell they to own cash.

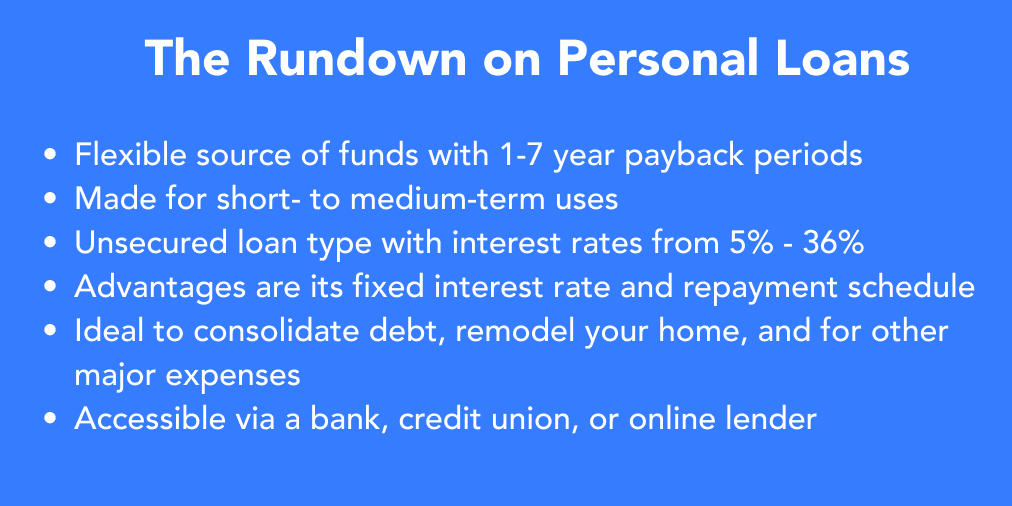

- Domestic collateral loans will let you borrow secured on your own equity: Borrowing from the bank up against your equity setting you could profit from your family collateral by taking away financing facing it. You may use it financing to pay for other expenditures, create home improvements, invest in a new house or make use of it in case there are a loans in Coal Creek crisis. Whenever you borrow on their guarantee, having it power could possibly get show of good use as time goes by.

- More security you may have, more you may cash in on promoting your property: If you have paid your entire financial before you can offer the household, you will get to save all-potential payouts regarding revenue. Occasionally, but not, manufacturers may not have paid off the entire home loan consequently they are required to get it done on the fresh new profit of their home. For many who nonetheless are obligated to pay cash on the home loan, this may connect with exactly how much your cash in on the brand new profit. Generally speaking, the greater number of household security you have, the more currency you might get in that deals.

- The chance to make use of your house collateral to lessen your financial situation and you will alter your creditworthiness: Cashing for the in your household collateral can help pay regarding almost every other costs. By paying regarding other costs, you will be coming down your debt-to-income ratio and eventually, improving your monetary health and creditworthiness.

How to build security into the a home

There are a method to generate security within the property, and many help you facilitate simply how much guarantee your create within the a shorter period of time:

- Build regular mortgage repayments: When you find yourself taking right out home financing, it’s best practice and also make normal, punctual mortgage payments. Once you make repayments timely, you prevent later charges and you can compounding interest. With each payment that goes toward your principal, you’re permitting create domestic equity.

- Generate very early or most mortgage payments: If you find yourself and come up with very early otherwise extra mortgage payments to your your own prominent, you’re probably strengthening house security quicker of the ortization agenda.

- Sweating security:Sweating guarantee is difficult performs that induce well worth. Instance, as opposed to buying a contractor making property improvement, you might plan to conserve that cash and then try to bring with the venture yourself. The money protected and prospective value added to your house get help build domestic security.

- Renovations: By creating home improvements one to enhance the value of your house, you’re and additionally increasing your home collateral. Like, finishing the basements and you may adding your bathrooms increases the practical rectangular footage of your house and eventually how much some one you are going to pay for your home, which facilitate build your house equity.

In summary

Strengthening home equity ‘s the idea of paying the mortgage and slowly running more info on of your home. Building household guarantee is actually trendy because you happen to be boosting your handle and you may ownership more than their house, which provides your having solutions having economic freedom such using your family security to change your home, defense expenses or earn profits when you promote your house. Envision talking-to property lending mentor to decide what masters you can acquire out-of experiencing your home collateral.