Although not, you should know when you can a specific equity percentage of your house, constantly 20%, you could potentially cancel the fresh PMI. And you will probably want to. More 30 years, an effective $150 monthly PMI payment adds up to over $54,000. The lenders doesn’t remind your as possible terminate new most fee, thus listen to just how much you have paid back.

How to prevent Spending PMI

State you are considering a good $300,000 house along with $20,000 towards the advance payment. Really loan providers will need an excellent PMI commission unless you set about $60,000 down, excluding the fresh credit costs. For most very first-time homebuyers, good $sixty,000 down-payment is out of practical question.

This might end up like a keen 80-15-5 type of bundle: your funds 80% toward a first home loan, 15% towards the an extra financial or home guarantee loan, and you can 5% since your down payment. Utilising the family-collateral loan as well as your advance payment, you could potentially control you to definitely number from the price of the home and you can cover the brand new 20% down needs, hence preventing the PMI.

Our home equity otherwise next loan may provides an excellent varying rates otherwise an increase greater than the majority of your financial, so you’ll want to keep an eye on it loan and you can make an effort to pay it off first. Home collateral mortgage attention is also allowable into the government taxes when the the mortgage was utilized to find, make or drastically increase an excellent taxpayer’s home. not, a https://paydayloanalabama.com/muscle-shoals/ wedded partners is restricted so you can deducting attract on the doing $750,000 in total financial financial obligation.

Variety of Funds

The latest 29-seasons fixed-speed financing continues to be widely known home loan. Most people choose these financing because their monthly premiums will remain constant.

Good 15-year fixed financing is starting to become popular as it decreases the day panorama of loan, and that ount of great interest paid down along side longevity of the loan. Fundamentally, these quicker-term finance has actually a lowered interest since financial was met with smaller interest exposure than a thirty-season loan.

A varying-rate home loan (ARM) has the benefit of a reduced-interest to possess a-flat time. The speed are able to become modified a-year, or they can be detailed once the “3-step one,” “5-step 1,” otherwise “7-1.” Having an effective “7-1” adjustable-rates financing, the degree of the loan might be repaired on the very first seven age and then would be modified beginning in this new eighth season based on current market standards. The individuals are often according to research by the one-seasons Treasury list.

Just how Possession Performs

Initial, the eye pricing towards Palms are going to be anywhere from that about three commission issues below the traditional repaired mortgage. If or not an arm suits you commonly depends on how enough time you intend in which to stay the house. In the case of the new “7-1,” if you simply want to stay-in the home to own eight many years, then it the best mortgage to you. Yet not, if you intend in which to stay the house for extended and you will rates beginning to increase, their monthly costs can rise notably.

Its really worth the additional work to review your own Closure Disclosure and you may contrast it toward Loan Estimate till the closing big date from the new domestic. In case your figures try excessive or you discover the new fees, contact the lender and inquire them to describe otherwise proper the fresh new problems. To find a home are a long-name commitment, so you should completely understand all regards to your own loan and not overlook any undetectable charges.

How can you Understand The Financial?

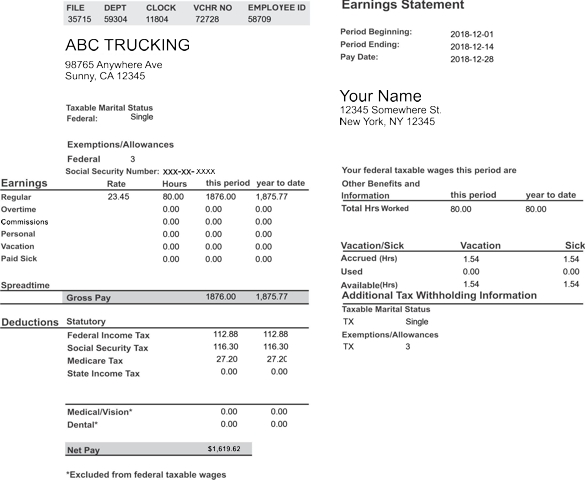

For individuals who already have a home loan and you’re trying to make sense of the statement. Possible usually select crucial items like the mortgage lender’s contact information, your bank account count, extent due on your own second fee, the payment date, this new a fantastic count you owe, your own interest rate, brand new escrow harmony, plus.