Although not, it is still projected one to merely a portion of eligible pros make use of money guaranteed because of the You.S Institution regarding Pros Products. You to fee might possibly be higher. Why don’t we speak about 10 crucial details about Virtual assistant funds so you’re able to find a very good home loan provider for the existence.

Accredited consumers with full entitlement and you may an amount borrowed higher than $144,000 will get get a house rather than a downpayment. Very money, particularly FHA and you will antique, require a step three.5 per cent to five % down payment. The ability to purchase a property rather than a deposit is a massive benefit to have army homebuyers who has otherwise got to help you abrasion and you can stockpile for many years.

No private home loan insurance rates requisite.

Additionally you need not shell out month-to-month personal financial insurance rates (PMI) otherwise arrange for a “piggyback” financial to pay for the deposit. Mortgage insurance is needed on the conventional finance having a deposit from below 20 percent–generally speaking, it is also necessary to the FHA and USDA finance. Zero monthly PMI repayments suggest Va consumers is expand the to shop for power and save yourself.

Low interest.

Virtual assistant finance is actually backed by the us government, that provides loan providers rely on to give favorable prices. Actually, Virtual assistant financing costs are generally a minimal in the market. Average 30-year Va financing fixed cost was indeed below traditional and FHA given that Ellie Mae, financing app organization, been remaining track from inside the .

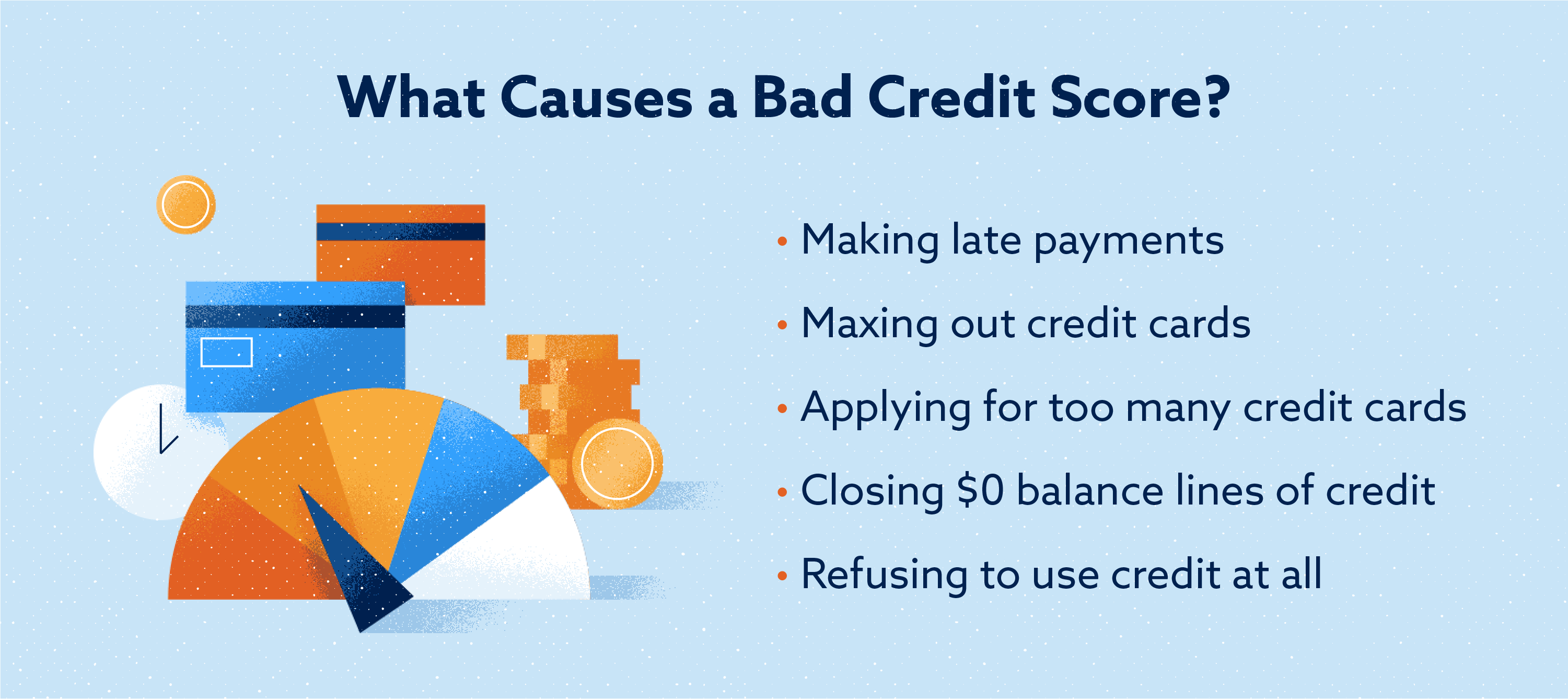

Informal borrowing conditions.

The fresh new Agency of Experts Items, the newest company one to oversees the newest Virtual assistant financing system, doesn’t place otherwise impose the absolute minimum credit rating. But not, it prompts loan providers and make a judgments. Different loan providers may have other requirements whenever examining an excellent borrower’s exposure, but generally, minimum requirements could well be lower than that from antique mortgages.

It’s important to mention–Va loans also are even more easy getting consumers who are rebounding out of bankruptcy proceeding, a foreclosures, otherwise a preliminary sale.

Flexible financial obligation-to-income percentages.

Your debt-to-earnings ratio is the month-to-month financial obligation repayments split by the terrible monthly income. This new Va it permits borrowers to own people DTI ratio, though lenders will normally like to see itat otherwise lower than 41 per cent. Particular lenders might go higher, depending on your credit rating or any other financial factors. It self-reliance could help Virtual assistant individuals in order to offer its buying fuel.

Faster closing costs.

One of the primary benefits associated with a great Virtual assistant-recognized loan ‘s the reduction of closing costs. The brand new Va it allows provider concessions but requires that provider concessions create perhaps not surpass 4% of the loan amount. Merchant concessions start from:

- Prepaying taxes and you will insurance policies towards the household

- Rate of interest buydowns

- The fresh buyer’s Va money percentage

- Settling judgments or borrowing from the bank balance with the customer’s part

- Gift suggestions (i.age. a microwave or dish washer)

While doing so, the seller pays the fresh borrower’s settlement costs which aren’t an element of the cuatro% calculation, together with conventional disregard products.

Existence benefit.

Certified pros having complete entitlement is borrow to their lender is actually happy to increase. Because of this when it is time for you to get a newer otherwise huge home, you could potentially submit an application for a good Virtual assistant mortgage once more.

- Features served getting ninety successive weeks in wartime or 181 successive months in the peacetime

- Possess half a dozen numerous years of provider on the Federal Shield otherwise Reserves

- Will be the partner out-of a service member

Enduring partners meet the requirements.

Virtual assistant money are around for thriving partners away from army participants just who passed away during effective responsibility otherwise right down to a beneficial service-connected disability whenever they have not remarried. Thriving partners can also be eligible if a person of these descriptions holds true:

- Its spouse try forgotten in action otherwise was a great prisoner off conflict

Numerous financing choice.

Certain experts try amazed to find out that there are a variety of Va financing apps readily available, for every single designed to complement a particular you need.

Qualified borrowers may use good Jumbo Va loan to buy or refinance if loan amount exceeds the standard loan limitations.

It is very important note–Jumbo Virtual assistant loans need a downpayment. Normally, the amount of deposit needed to your an excellent Virtual assistant Jumbo mortgage is somewhat below what is called for towards the a traditional jumbo mortgage. Virtual assistant Jumbo loans do not require home loan insurance.

Virtual assistant buy funds was exactly what they appear to be–financing to order property. The us government restricts extent and type off closing costs you to definitely can feel charged.

A beneficial Va re-finance* can be used to refinance a current loan or multiple loans. Same as that have get purchases, the total amount and type of closing costs that can easily be billed to your veteran was limited.

Interest Prevention Re-finance Loans (IRRRLs) try sleek loans established particularly for refinancing a house on what you’ve currently utilized the Virtual assistant mortgage qualification. It doesn’t require an assessment.

Normally, an enthusiastic IRRRL lowers the speed to your current Va financial. Although not, if you find yourself refinancing regarding a preexisting varying-price mortgage to help you a predetermined-speed, the interest rate can get improve. There isn’t any cashback allowed to the latest seasoned throughout the loan continues.

It is critical to note–new occupancy importance of a keen IRRRL is different from most other Virtual assistant funds. To possess a keen IRRRL, a seasoned only has in order to certify they’ve before occupied our home.

Va borrowers cannot use funds to acquire the next household or money spent and ought to certify that they intend to consume brand new assets once the a full-time living area. Although not, capable put it to use to do more than simply purchase a beneficial household. Being qualified individuals https://paydayloancolorado.net/jansen/ can use the cash so you’re able to:

It is essential to notice–Minimum Property Conditions need to be came across so you can be eligible for a great Virtual assistant mortgage. These types of criteria make sure experts and you will army family possess a safe family. They make up things such as heating and cooling options, water-supply, and sewage fingertips.

Might you Meet the requirements?

If you’re a seasoned, reservist, effective duty affiliate, otherwise thriving spouse, PacRes has to offer a great $step one,111 lender credit into all of the Federal Va financing started November step 1 due to November 29. Read more here or reach to learn more.