Your revenue can not be more than 115% of one’s average income in your community for which you need to find the property.

At exactly the same time, you need to demonstrated your ability to repay the loan into the bank, which means that having a reliable income source and you can a beneficial DTI out-of 43% otherwise down. Direct certification differ because of the financial.

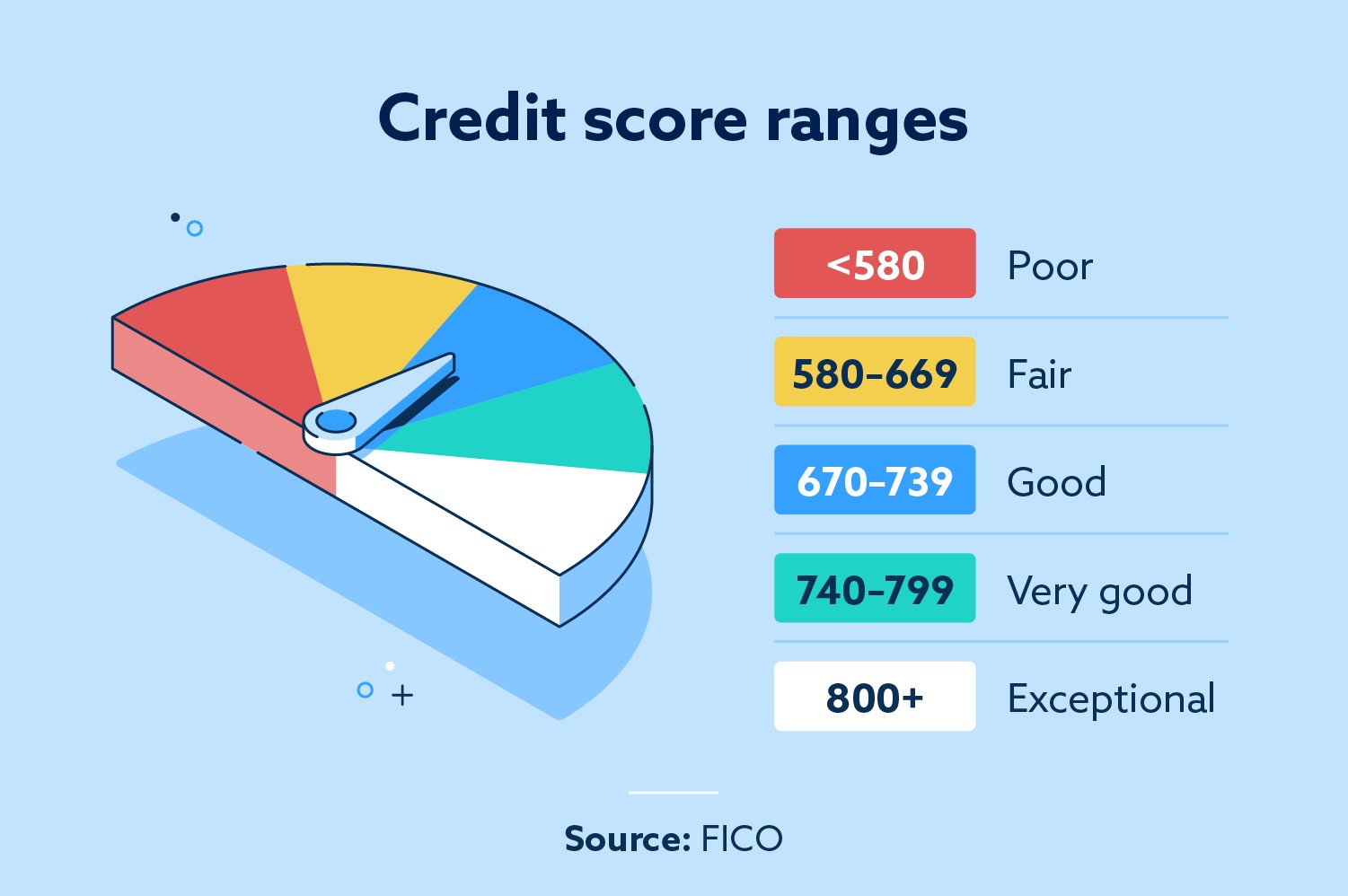

Credit history

The USDA cannot lay credit history standards, it is therefore doing the lending company. Extremely lenders like to see a score of at least 640, nevertheless might still qualify for a good USDA mortgage that have bad borrowing from the bank, depending on the financial or any other points.

Debt-to-income (DTI) ratio

The DTI methods the degree of your own gross income you to happens to the paying your debts per month. Extremely lenders like to see an excellent DTI out-of no more than 41%, standard with a lot of style of fund. This means one how oftern can you get payday loan only about 41% of the income goes toward expenses such as for instance established mortgage loans, automobile and personal loans, playing cards, an such like.

Venue

The house or property need to be situated in a qualified outlying area to help you be eligible for an effective USDA loan. This new USDA brings an interactive map that can help you look having elements otherwise kind of qualities to choose their qualification.

Assets dimensions

How big the house are unable to surpass dos,000 square feet to help you qualify for a USDA mortgage. not, there’s no possessions dimensions, so that your family can be situated on one quantity of house.

Defense criteria

The home have to be structurally voice, safer, and you may practical so you’re able to be eligible for a USDA financing. Lenders are required to hire a keen appraiser to own USDA financing characteristics to evaluate the property to choose its market value and ensure it adheres to USDA possessions condition assistance.

Usually, appraisers might possibly be searching for an effective structurally sound home with a great base and you can rooftop when you look at the good condition, making it possible for children to go from inside the as soon as possible. Indeed there should also be access to the house and you can Hvac solutions during the operating order.

They will certainly along with guarantee the electronic experience secure no unsealed cables and this the fresh new plumbing was practical. Additionally, your house can’t has actually proof of insect damage and really should adhere to local and county building codes.

FHA compared to. USDA Money

USDA and you can FHA financing are two of the very well-known government-supported funds as they slow down the will cost you of shopping for a house. Yet not, they truly are aimed toward different kinds of borrowers. Such as, USDA financing are to have consumers looking to buy property toward outlying home consequently they are limited for lower- so you can center-income family.

Likewise, FHA funds, supported by the fresh Government Property Government, much more widely available to own individuals and attributes of all types. There are not any earnings restrictions having so much more credit history requirements independence – ratings only 550 try acknowledged. At the same time, USDA fund come with a zero advance payment choice, if you are FHA loans still want an advance payment, while they can be lower while the 3.5%.

Borrowers who don’t qualify for USDA finance can still be eligible for FHA finance. At exactly the same time, these fund is more appealing if not must be simply for a specific area.

Each other programs are around for first houses only, however with FHA funds, you can get multiple-nearest and dearest property with several gadgets. At exactly the same time, each other support earliest-time home customer offers to further lower your costs of purchasing a home.

Advantages and disadvantages out-of USDA Financing

With no downpayment requirements and much more flexible financing criteria, USDA finance was attractive to of numerous individuals. But not, they aren’t the right option for the domestic customer. Training advantages and you will cons of USDA money helps you result in the finest choice centered on your financial situation and you may a lot of time-label goals.