KeyBank went on their ages-enough time retreat away from promoting Black and you will lower-earnings homeownership when you look at the 2022, a diagnosis quite previous government studies on financial lending shows.

Black colored borrowers made only dos.6% of the Cleveland-centered bank’s household buy financial credit in 2022, down regarding step three% the year earlier in the day. KeyBank could have been pulling back from support Black colored homeownership every year since 2018, when six.5% of the family buy fund went to a black debtor.

KeyBank generated 19.2% of its household get financing on season to low- and you may reasonable-income (LMI) individuals, off off 19.7% in 2021. This modest but significant you to-season refuse understates KeyBank’s longer-term performance having low-wealthy parents trying to pick a house to reside: In the 2018 more than 38% of such KeyBank fund went along to an enthusiastic LMI borrower.

Both data factors look even uglier in comparison to other best loan providers, whom produced more than 31% of the 2022 buy mortgages to LMI borrowers and you will in the eight% ones to Black individuals.

KeyBank’s constant withdrawal out of Black and you may low-rich consumers looking to purchase a property works avoid on the spirit of your arrangement it made out of society leadership when you find yourself trying approval to possess good merger in the 2016, because a study i published a year ago reported. In identical months away from 2018 to help you 2022 in the event that financial was progressing the home loan organization to help you richer, Whiter groups, their executives noticed match in order to hike shareholder dividends using the the newest payouts about merger associated with the because the-damaged promises.

Our very own 2022 declaration outlined KeyBank’s big failure for the offering lower and you may moderate-earnings (LMI) and you will Black consumers inside groups they bound to greatly help. KeyBank in the 2016 finalized a community Pros Agreement (CBA) into the Federal People Reinvestment Coalition (NCRC) as well as other society groups representing people exact same borrowers’ passion across the nation. The offer try instrumental inside the satisfying judge and regulating standards from inside the KeyBank’s successful merger with Basic Niagara Financial.

Because of the 2021, KeyBank has been around since brand new bad biggest mortgage lender getting Black borrowers. NCRC slash ties that have KeyBank shortly after studying the fresh bank’s abandonment regarding Black colored and you will LMI borrowers. We notified bodies your lender is always to discover a good downgraded Community Reinvestment Work rating . And even though the bank initial given mistaken and inaccurate solutions saying it had not complete exactly what the quantity tell you, it had been after compelled to percentage a beneficial racial collateral review just after shareholders applied stress more the results.

New 2018-2021 development one caused NCRC’s . Despite claiming for enhanced financing to help you LMI consumers once the a beneficial show of the lending, KeyBank possess failed to make significant strides. The newest investigation plus after that undermine KeyBank’s social spin in reaction so you’re able to NCRC’s findings.

NCRC’s earlier declaration layer 2018-2021 already decorated an effective damning image of KeyBank’s methods article-merger. The financial institution methodically and you may blatantly cut back on loans towards the really consumers they vowed to greatly help and you may maps of its credit models exhibited the lending company systematically stopped Black teams. We subsequent learned that KeyBank did not provide financing just as to help you Black and white consumers, and you may substantially slash their show off lending in order to LMI individuals even with past pledges. It is currently clear the exact same trend we had been in a position to determine at financial inside history year’s statement went on by way of 2022 as well.

The fresh new numbers to own 2022 deserve specific framework. Last year was a period of outrageous change in the mortgage field, since rates of interest spiked on the high reason for 2 decades. Changes in rates regarding 2021 so you’re able to 2022 influenced every mortgage loan providers all over the country. The fresh new usually low interest rates out of 2020 and you may 2021, and that noticed the newest 29-season repaired speed mortgage dipping to help you dos.65%, would give treatment for a maximum of over seven% towards the end out of 2022.

Financial Costs 2002 2022

It expanded age of reduced cost, accompanied by a spike for the highest costs during the more than 20 many years, radically reshaped the overall home loan opportunities. It is therefore not surprising one to KeyBank’s full mortgage business shrank dramatically during the 2021 a representation regarding world-wide trend. KeyBank made 29,895 total mortgage loans of all types inside the 2022, off 35% regarding 2021.

However, so it lose-out of overall mortgage financing is generally inspired by evaporation regarding re-finance and cash-away visit their site refinance money borrowing that’s linked with a home, not into key inflection point in the newest financial well getting of a household who has got previously hired. KeyBank made below you to-third as many particularly non-pick mortgage loans this past year since it had into the 2021, dropping from more than twenty seven,000 to help you lower than 9,000.

Meanwhile, domestic purchase financing rarely dipped. From inside the 2022, KeyBank produced 9,900 household purchase finance, a fairly small step 3.6% shed from the ten,265 such as fund they built in 2021.

Home buy fund will be no. 1 signal out-of an effective lender’s show into the closing this new racial homeownership and you will riches divides, because they depict house making the leap about money-eroding fact of leasing with the wide range-strengthening hope out of having.

Despite managing to save the total number of household purchase credit seemingly stable when you look at the rate of interest chaos out-of 2022, KeyBank proceeded flipping out-of Black colored consumers. Only 2.6% of the house get lending went to a black colored debtor history seasons down from the past year’s 3% share. KeyBank have failed to increase the home pick lending in order to Black colored homeowners. Factoring re also-fi financing back in will not contrary that pattern.

KeyBank’s reaction to past year’s statement were to tout a good 24% increase in lending in order to African-Americans, a figure which can voice unbelievable it is worthless when considered from the overall display of the loans. The new 2022 quantity continue to lay KeyBank at the bottom out-of the major fifty lenders in the loans so you can Black colored consumers, having just dos.5% of 30,895 finance attending a black borrower. The financial institution along with ranked improperly in other minority lending classes: second-poor having Hispanic borrowers, third-worst for minority-majority tract lending and for lending into the LMI census tracts, and you may 4th-terrible for minority borrower lending complete.

Ideal 50 Loan providers For the 2022 by the Group

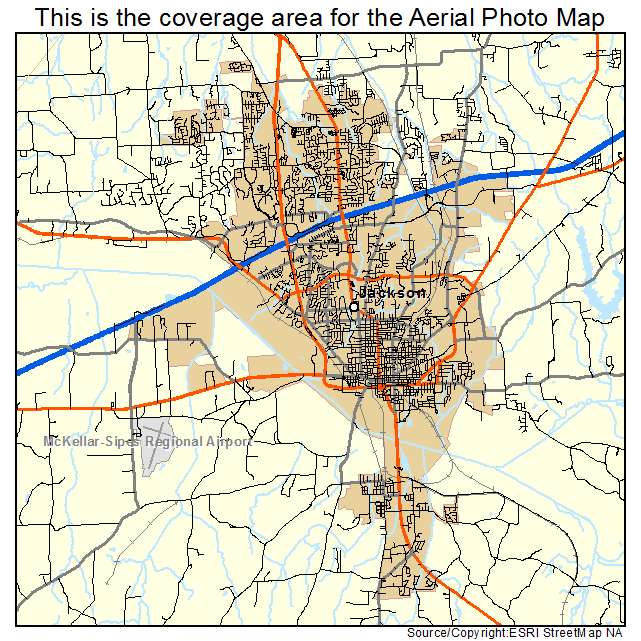

A study of KeyBank’s pastime inside their top ten areas corroborates this type of results. In lot of locations, KeyBank ranks in the or close to the bottom in those urban area parts when it comes to lending in order to Black colored and LMI homebuyers opposed into top banking institutions regarding 2022 originations into the that urban area. Their abilities ranges from average in order to outright bad, neglecting to prioritize funding in these important demographics again, even with pledging to achieve this on paper 7 in years past when government was provided whether or not to approve a good merger that made KeyBank’s insiders wealthier. New amounts confirm that KeyBank hasn’t prioritized capital for the LMI borrowers, even after their explicit dedication to perform just that.

KeyBank’s Finest Places

The content from 2022 merely sharpens the image from KeyBank’s unfulfilled requirements. Their inability so you can effectively suffice Black and LMI borrowers is not simply a violation out-of faith plus a significant burden to help you people advancement. Talking about maybe not simple analytics; it portray lifetime and communities you to will always be underserved. In addition they subsequent discredit the new bank’s societal spin of their bad run.