??The new imagine owning a home about Solitary Superstar State are nearer than do you consider, courtesy FHA Money within the Texas. Such regulators-supported mortgage loans open gates getting earliest-time homeowners, those with faster-than-finest borrowing, and you may people seeking to a cheaper way to homeownership. If you’re questioning in regards to the FHA Mortgage criteria within the Colorado having 2024, you’ve started to the right place.

But what Exactly Was an enthusiastic FHA Loan?

Its a mortgage covered by Federal Property Government, a part of the us Company regarding Housing and you may Urban Development (HUD). That it insurance policies allows lenders such as for instance DSLD Financial to provide far more versatile terminology, and reduce percentage possibilities and you will potentially down credit rating standards than just Old-fashioned Financing .

Tx try a primary spot for FHA Loans. Regardless if you are eyeing a cozy cottage when you look at the Austin, a spacious family home inside Dallas, or a charming farm in San Antonio, FHA capital will help turn your Colorado homeownership hopes and dreams to the fact.

At the DSLD Financial, we specialize in helping Texans create the FHA Financing process. We be sure you understand the FHA Loan requirements from inside the Colorado and you can find the correct financial to fit your means and you will finances. Let us check out the information so you can with confidence take the first step towards your new house.

FHA Mortgage Requirements during the Texas: Credit score

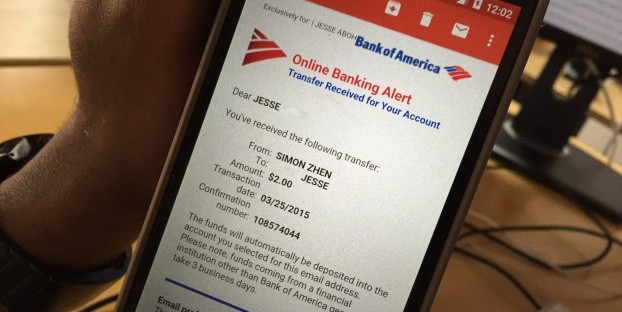

Regarding FHA Mortgage standards inside Texas, your credit score takes on a critical character. It is an excellent 3-thumb amount one to reflects your creditworthiness centered on the reputation of borrowing and you may settling expenses. Minimal credit rating needed for a keen FHA Financing in Colorado are 580.

In case the score suits otherwise is higher than so it endurance, you are able to qualify for a low down payment option of 3.5%. Yet not, with a higher credit score is unlock gates to better interest levels, potentially saving you several thousand dollars along side lifetime of your mortgage.

Thus, can you imagine your credit score drops underneath the 580 mark? Never anxiety! There are still solutions. You are in a position to meet the requirements Kittredge CO bad credit loan that have a higher advance payment, normally ten%. Also, providing steps to improve your credit score as a result of in control economic models can increase your odds of protecting an FHA Financing with more beneficial words later.

FHA Mortgage Criteria in Tx: Down-payment

Probably one of the most glamorous regions of FHA Money inside the Tx ‘s the low-down percentage demands. With the very least credit history of 580, you can qualify for a down payment as low as step 3.5% of home’s cost. This is going to make FHA Loans ideal for very first-big date homeowners exactly who might not have significant offers to own more substantial down-payment.

Although not, in case the credit score falls below 580, you may still qualify for a keen FHA Mortgage that have a high down-payment from 10%. It’s really worth noting you to definitely specific loan providers or apps can offer off payment recommendations solutions, that after that slow down the upfront will cost you of purchasing a property.

Such as, envision your perfect home inside Colorado are noted to possess $2 hundred,000. For those who qualify for an enthusiastic FHA Financing having the absolute minimum credit score out-of 580, your downpayment requirements would be merely step 3.5% of that rates.

This means you simply you need $eight,000 initial to purchase your $200,000 dream family! This might be a significantly smaller amount as compared to 20% down payment typically you’ll need for Traditional Fund, which could be $forty,000 in this situation.

FHA Loans’ lower down percentage requirements makes them such popular with first-big date homeowners who may not have had the day or information to save quite a bit of currency having a down payment. They discover the doorway so you can homeownership eventually making it a great a lot more possible mission.