A rule of thumb to have skills closing costs is it: the lower their interest are, the greater amount of you are going to spend into the issues (that can be found in your closing costs). The higher your own rate of interest, the reduced your own facts.

Lower Rate, Higher Closing costs

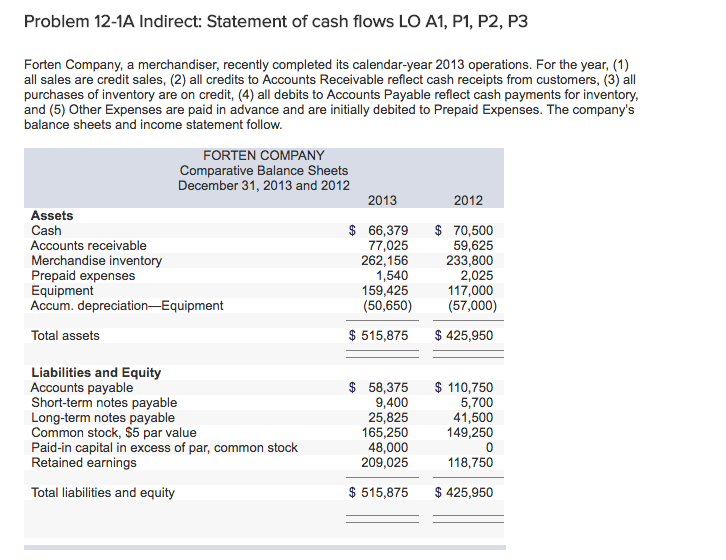

During writing, the average Utah home loan rates was 6.105%. These are *samples of genuine prices. You will see the low the interest rate given, the higher the fresh closing costs.

*Prices a lot more than are an illustration, and are also not associate away from the present pricing. Delight glance at the current pricing with your Discover The best Rates Product .

Higher rate, All the way down Settlement costs

On the other stop of your own spectrum, you can observe exactly how closure having a higher rate is also substantially bring your closing costs down.

*Pricing over are a good example, and are perhaps not user out-of the current pricing. Please have a look at today’s rates with the Pick Your very best Rate Equipment .

Occasionally, for individuals who agree to a top enough interest, you could get closing costs taken care of you, or work as a credit into your loan. The fresh new drawback during these points try a higher level and you can month-to-month payment.

*Prices significantly more than is a good example, and so are maybe not affiliate off the current pricing. Delight take a look at the present rates with these Look for The best Price Tool .

We do not imagine settlement costs. We let you know exactly what they will feel when make use of our very own equipment.

7 Tips for Negotiating Your Settlement costs

There isn’t any enchanting words instance, Reducio! that actually works to help you compress their closing costs. Nevertheless these info can assist browse your house purchasing experience very you know you’re no less than getting the lowest price you can.

step 1. Research rates : See numerous mortgage rates out-of additional lenders evaluate settlement costs. This should help you select and this financial supplies the greatest words and you can reasonable charges. Definitely examine cost regarding the same big date, and you may exclude things such as escrows & prepaids (due to the fact not absolutely all lenders loans in Hamilton no credit check were all of them, and they’re going to become exact same regardless of where you personal the loan).

dos. Ask How will you allow us to aside : Some settlement costs provides wiggle room. Ask what they does about how to all the way down fees, like mortgage origination charge, dismiss items, appraisals, or underwriting fees.

3. Ask owner to own concessions : When you are to buy a property, it can make sense to discuss into supplier to own them purchase a fraction of their settlement costs. This is prone to occur in a buyer’s industry. Pose a question to your financial otherwise real estate agent if they perform remind or discourage that it according to the disease.

cuatro. Request to close off at the end of the newest times (if possible) : From the scheduling the closure by the end of week, you might slow down the number of prepaid attract, also known as per diem appeal, that’s needed is in the closure.

5. Like an effective no-closing-cost financial : Some loan providers bring mortgage loans the place you choose a high rate that talks about the settlement costs. It isn’t most a zero-closing prices financial, they have been merely included in your own borrowing on interest. You generally like this package if you think rates is certainly going all the way down prior to your own break-also point. Youre gaining a far more most readily useful disease in the small-term, however, you are trade one getting a reduced favorable financial burden inside brand new long-title, or even re-finance to a diminished price.

6. Query whenever they offer discounts to own bundled functions : Certain lenders and you will title organizations make discounts available by using its connected qualities, such as for example identity insurance policies or escrow services.