A suspense account is essentially a bookkeeping technique for keeping track of funds for a brief period until particular issues are resolved. A business can use a suspense account to record payments it has received but that can’t be properly accounted for until certain missing information (such as an invoice number) is obtained. In mortgage servicing, it is a way for the servicer to record incomplete monthly payments until the borrower has made the payment in full.

Where is suspense account shown in the financial statements?

Suspense accounts serve as temporary placeholders in accounting, helping to manage transactions that cannot be immediately classified or resolved. The use of a mortgage suspense account helps ensure that payments are not misapplied or remain unaccounted for while processing. It serves as a safeguard that keeps funds in a known location until all the details can be sorted out and the payments can be accurately applied to the mortgage as intended.

Double Entry Bookkeeping

QuickBooks suspense account is a control account that works as a holding account until any issue is highlighted or the unrecognizable transaction is detected. In this guide, we have talked about suspense accounts and in what situations you need to use them. For example, when a transaction is carried out and is coded incorrectly, they cannot be further processed immediately. Other conditions may also include missing an account number on a loan, deposit transaction, or even a check drawn on a depositor’s account that is not properly endorsed or signed by the depositor.

Cash Flow Statement

If an expense is incurred, the benefit of which is received by more than one account, such an expense can temporarily be placed in a suspense account. Later, the entries can be transferred to the relevant accounts at the appropriate ratio. One important use of a suspense account is to bring the trial balance into agreement.

- He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- For example, the periodic account statements that servicers are responsible for providing to borrowers must indicate any payments that have been put into a suspense account and the total amount of money in that account.

- Because transactions in a suspense account are unallocated, the account should be considered temporary.

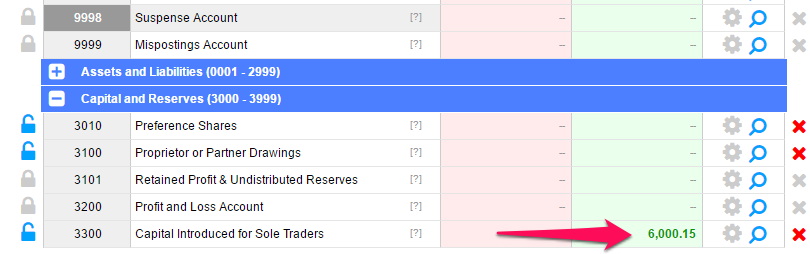

- In case a suspense a/c is not closed at the end of an accounting period, the balance in suspense account is shown on the asset side of a balance sheet if it is a “Debit balance”.

On 1 September 20X8, Michelle had a balance outstanding owed to one of her suppliers of $400. Michelle and the supplier agreed to settle the balance owed to Michelle through a contra entry. To record this, Michelle processed a journal entry to remove both the $400 trade payable and $500 trade receivable and posted the difference to the suspense account. Large corporations can clear their suspense accounts periodically, whereas small enterprises can do so more often. After which, they need to debit the suspense account and credit the accounts payable. Once the department has been specified, the accountant or management will be able to quickly bill that department.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Additionally, covering 100% of GL accounts the Substantiation module provides a summary of the unreconciled items, enabling organizations to proactively take corrective actions in real-time. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Essentially, a suspense account acts as a catch-all category for items that are pending further investigation or resolution. Whether intentional or accidental, partial payments can be tricky to match up to invoices. You can hold them in a suspense account until you know which account they should move to. An illustrative example Michelle runs suspense account in balance sheet a small business and does her own bookkeeping but does not have very much experience in this yet. There have been times throughout the year when Michelle has used a suspense account because she was unsure of the correct accounting treatment. She also thinks there may be other errors which occurred that did not involve a suspense account.

When debits and credits don’t match, hold the difference in a suspense account until you correct it. In accounting for small business, most suspense accounts are cleared out on a regular basis. Move suspense account entries into their designated accounts to make the suspense balance zero. When you open an accounting suspense account, the transaction is considered in suspense. While businesses of all sizes normally include a suspense account within their accounting scheme, they are of particular concern to insurance companies. A typical insurance company could have hundreds of suspense accounts (20–25 percent of their total balance sheet accounts) that hold thousands of items.