At the product level In a manufacturing company, variable costs change, depending on the volume of production. As more units are produced, total variable costs for the product increase. Earlier, we learned about the characteristics of fixed and variable costs and introduced the basics of cost behavior. Let’s now apply these behaviors to the concept of contribution margin.

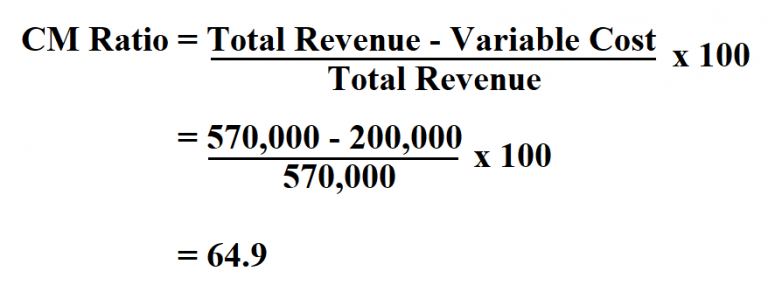

Contribution Margin Ratio

For instance, if you sell a product for $100 and the unit variable cost is $40, then using the formula, the unit contribution margin for your product is $60 ($100-$40). This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit. This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit. The contribution margin is important because it helps your business determine whether selling prices at least cover variable costs that change depending on the activity level.

How to calculate contribution margin

However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin. Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income. Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income.

Formula and Calculation of Contribution Margin

One reason might be to meet company goals, such as gaining market share. Other reasons include being a leader in the use of innovation and improving efficiencies. If a company uses the latest technology, such as online ordering and delivery, this may help the company attract a new type of customer or create loyalty with longstanding customers. In addition, although fixed costs are riskier because they exist regardless of the sales level, once those fixed costs are met, profits grow. All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit. Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently.

A good contribution margin is one that will cover both variable and fixed costs, to at least reach the breakeven point. A low contribution margin or average contribution margin may get your company to break even. The variable costs to produce the baseball include direct raw materials, direct labor, why business budget planning is so important and other direct production costs that vary with volume. To calculate contribution margin (CM) by product, calculate it for each product on a per-unit basis. After you’ve completed the unit contribution margin calculation, you can also determine the contribution margin by product in total dollars.

- If they sold \(250\) shirts, again assuming an individual variable cost per shirt of \(\$10\), then the total variable costs would \(\$2,500 (250 × \$10)\).

- Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations.

- Such fixed costs are not considered in the contribution margin calculations.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- It is considered a managerial ratio because companies rarely report margins to the public.

If the total contribution margin earned in a period exceeds the fixed costs for that period, the business will make a profit. If the total contribution margin is less than the fixed costs, the business will show a loss. In this way, contribution margin becomes an important factor when calculating your break-even point, which is the point at which sales revenue and costs are exactly even ($0 profit). This, in turn, can help you make better informed pricing decisions, but break-even analysis won’t show how much you need to cover costs and make a profit. For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s.

There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs. However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low. Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10). If the contribution margin is too low, the current price point may need to be reconsidered. In such cases, the price of the product should be adjusted for the offering to be economically viable. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

You can find the contribution margin per unit using the equation shown below. Conceptually, the contribution margin ratio reveals essential information about a manager’s ability to control costs. For example, if sales double, variable costs double too, and vice versa. Direct variable costs include direct material cost and direct labor cost.