When your totally new home loan is a thirty-season title (or more), following refinancing is a great way to get with the best goal of securing inside the an excellent fifteen-12 months repaired-speed home loan.

We say 15-seasons fixed-price mortgage loans will be objective because they’re much better than 30-season mortgage loans. You can pay-off your property reduced and you will conserve a lot of currency just like the you happen to be missing fifteen years’ worth of desire repayments. (Score!)

Today, a 15-year fixed-speed financial might increase your monthly payment a little while. Remember to keep your this new commission in order to no more than 25% of your own bring-home pay.

It all boils down to so it: We want to individual your property as fast as possible rather of your home owning you! Use our very own financial calculator to run the numbers and see what your monthly payment would-be for the an effective fifteen-season loan.

4. Combine Your second Financial-if it is More than half Your Yearly loans Sterling no credit check Money

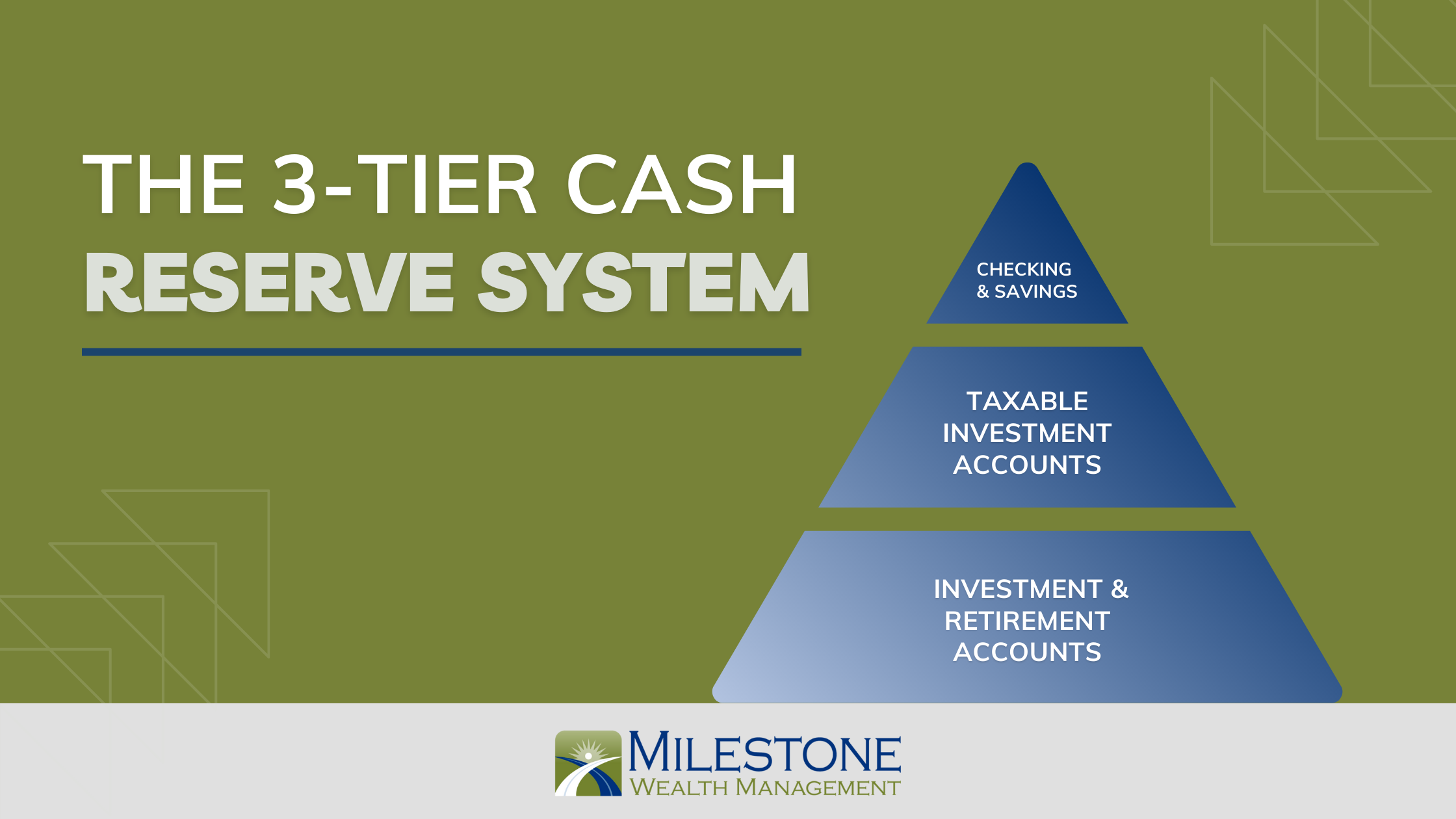

Some homeowners need to roll its next mortgages to your a great re-finance of its first-mortgage. not so fast! If the equilibrium on the second financial is fewer than half of yearly income, you’ll do better just to pay it back with the rest of your loans during your obligations snowball.

If the balance is higher than half of your annual income, you will want to re-finance your next financial together with your first one. This may put you inside a stronger updates to experience this new other expense you could have before you could pull their info along with her to pay off your mortgages forever!

Whenever Was Refinancing a bad idea?

Okay, very there is covered 4 times you truly will be refinance. Although realities in the refinancing the home loan would be the fact you’ll find definitely times when never get it done. We’re going to give you some situations.

- Score a new auto

- Pay off credit cards

- Upgrade the kitchen (and other section of your home)

- Retract almost every other personal debt (credit cards, student education loans, scientific costs, an such like.) towards the a refinanced home loan

Wiping your family guarantee (aka the latest element of your house you’ve already covered) to buy new stuff you don’t need to sets your property at risk-particularly if you reduce your task otherwise provides other currency situations. So when very much like your ped kitchen area otherwise their dated, out-of-build auto, you don’t have a separate one!

Don’t combine or roll up most other financial obligation towards the one gigantic refinanced mortgage since it is better to repay your own shorter expenses first. Effective which have cash is 80% conclusion and you may 20% lead studies. So that you be in the latest habit of paying down the individuals brief costs, get energized of men and women victories, immediately after which you will be prepared to handle the borrowed funds!

Oh, and you can a word to all your education loan proprietors available to you: Lumping your education loan loans to your mortgage mode it is heading to take even more time for you to pay-off men and women financing and your mortgage too. They throws your even further out-of completing often ones goals. No thanks a lot!

Can you imagine I can’t Pay My Latest Mortgage?

If you are underemployed immediately otherwise you happen to be shopping for it hard to shell out your own home loan because of events you decided not to manage, do not disheartenment! Based your situation, you will be able to get financial assistance through a federal or state program, get mortgage repayments decreased, if not place your costs on the keep for a short time.

Carrying out that can help elevator the duty you will be perception nowadays while concerned with when you will see your future income. However it is not the best solution. A good thing you can certainly do immediately was go back into the workforce-whether or not it means getting a job that’s external your field-so you’re able to start making concludes see.