To invest in property is a significant economic decision that often comes to thousands of bucks. We would not be capable manage homeownership without having any assistance of mortgage brokers. Because of the capital house purchases as a consequence of mortgage loans, loan providers pave the way for all those away from all the walks of life to learn their hopes for home ownership.

Home loan businesses could possibly offer an array of lenders, off old-fashioned repaired-rates mortgages to help you bodies-supported loans, in order to meet the requirements of home buyers with various monetary things. An informed mortgage brokers will get work on individuals to discover the proper loan product to fit its affairs, also whoever has subpar credit scores otherwise irregular earnings streams.

It could be enticing to select the loan providers giving a low interest levels, however, finding the best lending company for every state means much so much more browse than looking at costs by yourself. By the looking at its alternatives from every you’ll angle, consumers can be glean a over knowledge of what for each organization provides towards desk and those that tend to contains the combination off positives that count most due to their variety of situations.

- Greatest Total:PNC

- RUNNER-UP:Caliber Lenders

- Ideal Online Experience:Guaranteed Rates

- Best App Procedure:Rocket Home loan

- Top Deals:SoFi

- Good for Virtual assistant Fund:Experts United

- Contemplate:Ideal

Financial enterprises can vary notably-perhaps the finest mortgage brokers may offer different types of finance and you can money conditions getting people to take on. Rates circumstances, and additionally home loan rates and you may annual percentage costs (APR), will likely move from lender to help you financial. At the same time, for every organization are certain to get a unique qualifications standards one to possible borrowers need certainly to see so you’re able to qualify for a loan. Experiential circumstances, for example app process, closing timelines, and you may underwriting procedure, could all be additional according to financial.

Qualification Requirements

When you’re specific financial activities possess consistent baseline conditions that individuals you need to get to know to qualify-FHA financing, including-loan providers also maintain her qualification standards to own consumers. These types of conditions are in destination to prevent financial exposure towards lender and relieve the probability of a mortgage default.

Eligibility criteria are not authored and can be determined towards the an instance-by-instance basis, but some prominent situations include the size of the down-payment, new borrower’s loans-to-earnings (DTI) ratio, the credit score, their monthly earnings, or other monetary considerations. This type of qualifications criteria understand what types of lenders a debtor qualifies to own, the size of the borrowed funds they can rating, as well as the rate of interest attached to the mortgage. Given that per financial features its own standards, home buyers could possibly get be eligible for certain financing words which have that mortgage business, but not another.

https://paydayloancolorado.net/gunnison/

App Procedure

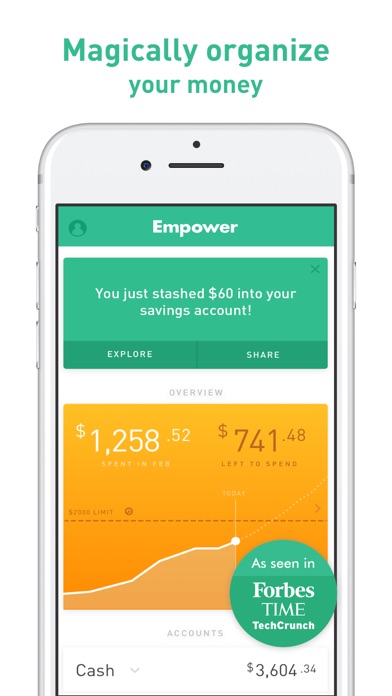

Making an application for a mortgage can seem to be daunting to possess first-day homebuyers and you can educated homeowners the same-one another due to the quantity of records required while the peak off analysis inside it. Specific lenders will endeavour to help make the application techniques more relaxing for consumers by permitting them to apply on line otherwise using a mobile application, entry digital copies off expected records and finalizing documents digitally in the place of actually ever meeting in person having financing officer. In addition, particular home buyers may prefer to meet with financing manager truly-or perhaps consult with them over the phone-whenever obtaining a mortgage, and they may want to discover a mortgage business that see the individuals demands.

Some other factor to look at is the secure-within the several months to your home loan rate. When a mortgage is approved, individuals might have the possibility in order to lock in their attention rates this will not changes between financing recognition and you will closure. Financial prices normally vary dramatically off time to time, and even out of time so you’re able to hours, so that the power to pounce towards reduced cost before it probably raise can be very appealing. Lenders will get secure rates for several periods of time, however the Individual Financial Safeguards Agency notes you to definitely 30, forty-five, and you can 60-time rate secure periods all are.